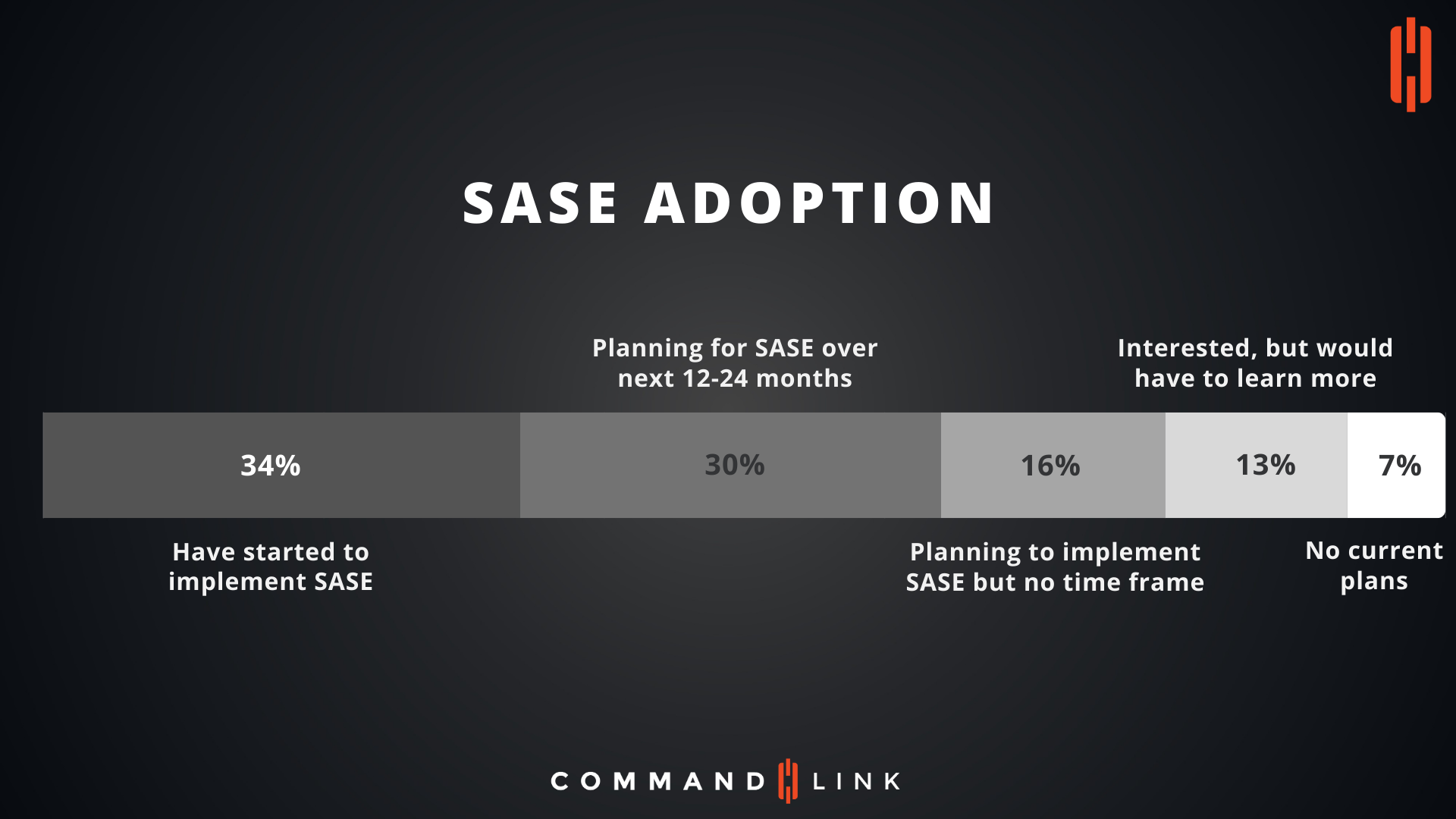

The Secure Access Service Edge (SASE) framework is gaining traction as organizations seek to modernize their network and security infrastructures. The image provides an overview of where organizations currently stand in their SASE adoption journey and their plans for the near future. Let’s break down these findings and explore what they mean for the broader trend of SASE adoption.

1. Have Started to Implement SASE (34%)

- What It Means: A significant 34% of organizations have already begun implementing SASE. This indicates that a substantial portion of the market recognizes the benefits of SASE in providing a unified approach to networking and security.

- Key Drivers: Organizations in this category are likely driven by the need to support a distributed workforce, enhance security posture, and simplify network management. The combination of these factors makes SASE an attractive solution for modern enterprises.

2. Planning for SASE Over the Next 12-24 Months (30%)

- What It Means: Another 30% of organizations are in the planning stages for SASE adoption, aiming to implement it within the next one to two years. This group is taking a proactive approach, preparing to address future networking and security challenges.

- Key Drivers: These organizations are likely conducting evaluations, setting budgets, and defining their SASE strategies. They recognize the importance of SASE but are taking the time to ensure a smooth transition and integration with existing systems.

3. Planning to Implement SASE But No Time Frame (16%)

- What It Means: 16% of organizations have plans to implement SASE but have not set a specific timeline. This indicates a level of interest and intent, though these organizations may face obstacles such as budget constraints, competing priorities, or uncertainty about the technology.

- Key Drivers: Organizations in this category may be waiting for further market maturity, additional vendor offerings, or internal readiness before committing to a timeline for implementation.

4. Interested, But Would Have to Learn More (13%)

- What It Means: 13% of organizations express interest in SASE but acknowledge that they need to learn more before making any decisions. This group is in the early stages of exploration and may be gathering information, assessing use cases, and evaluating vendor solutions.

- Key Drivers: The need for a better understanding of SASE’s benefits, costs, and implementation challenges is driving this group’s cautious approach. These organizations may benefit from targeted education, case studies, and pilot programs to build confidence in adopting SASE.

5. No Current Plans (7%)

- What It Means: A small portion, 7%, of organizations currently have no plans to adopt SASE. This could be due to a variety of reasons, including satisfaction with their existing network and security infrastructure, a lack of perceived need, or other strategic priorities taking precedence.

- Key Drivers: These organizations might be in industries or regions where the push for digital transformation is less urgent, or they may be smaller enterprises with limited resources to invest in new technologies.

The data on SASE adoption reflects a growing recognition of the need for integrated network and security solutions in a world increasingly defined by remote work, cloud adoption, and evolving cyber threats. While a significant portion of organizations has already started implementing SASE, many others are planning their approach or seeking to learn more before taking the plunge.

As SASE continues to gain momentum, we can expect to see more organizations moving from the planning phase to active implementation. Vendors and service providers that offer clear guidance, robust support, and flexible solutions will be well-positioned to capture this growing market demand. For organizations still on the fence, now is the time to explore SASE’s potential and how it can support their long-term IT and business goals.